Feie Calculator Things To Know Before You Get This

Wiki Article

Excitement About Feie Calculator

Table of ContentsThe Ultimate Guide To Feie Calculator10 Simple Techniques For Feie CalculatorSome Known Incorrect Statements About Feie Calculator The Ultimate Guide To Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

He marketed his United state home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his other half to aid accomplish the Bona Fide Residency Test. Neil directs out that buying home abroad can be challenging without first experiencing the area."We'll absolutely be beyond that. Also if we come back to the US for doctor's consultations or company telephone calls, I doubt we'll invest more than thirty days in the United States in any type of offered 12-month period." Neil highlights the importance of stringent monitoring of U.S. visits (Bona Fide Residency Test for FEIE). "It's something that people need to be truly diligent regarding," he claims, and advises expats to be careful of usual mistakes, such as overstaying in the U.S.

Our Feie Calculator Diaries

tax responsibilities. "The reason why U.S. taxes on worldwide earnings is such a huge offer is because lots of individuals forget they're still subject to U.S. tax obligation even after moving." The united state is among minority countries that taxes its people no matter where they live, indicating that even if a deportee has no revenue from united statetax obligation return. "The Foreign Tax Credit report allows individuals functioning in high-tax countries like the UK to offset their united state tax obligation liability by the quantity they have actually currently paid in tax obligations abroad," says Lewis. This guarantees that expats are not taxed twice on the same revenue. Those in low- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

Feie Calculator for Beginners

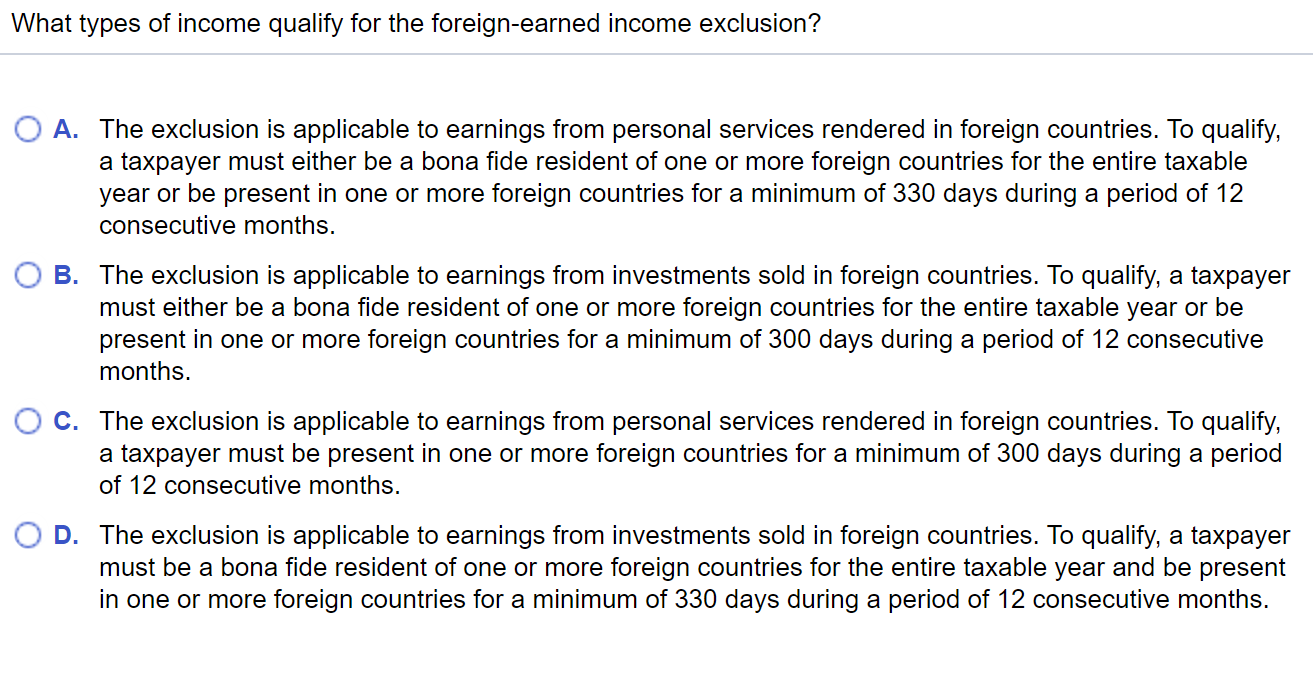

Below are a few of one of the most regularly asked inquiries regarding the FEIE and other exemptions The Foreign Earned Earnings Exclusion (FEIE) permits united state taxpayers to leave out as much as $130,000 of foreign-earned earnings from federal earnings tax obligation, lowering their U.S. tax obligation. To receive FEIE, you have to meet either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Test (confirm your key residence in a foreign country for an entire tax year).

The Physical Presence Examination additionally calls for United state taxpayers to have both a foreign earnings and a foreign tax obligation home.

All about Feie Calculator

An income tax obligation treaty between the united state and one more nation can assist avoid dual taxation. While the Foreign Earned Income Exclusion reduces taxable revenue, a treaty may provide added benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declare united state citizens with over $10,000 in foreign economic accounts.Qualification for FEIE depends on meeting certain residency or physical presence tests. He has over thirty years of experience and currently specializes in CFO services, equity payment, copyright taxation, cannabis taxes and separation associated tax/financial planning issues. He is a deportee based in Mexico.

The international made revenue exclusions, sometimes referred to as the Sec. 911 exclusions, leave out tax on incomes earned from functioning abroad.

The 15-Second Trick For Feie Calculator

The income exemption is currently indexed for inflation. The optimal annual income exemption is $130,000 for 2025. The tax obligation advantage excludes the earnings from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" decreasing revenue based on tax on top tax prices. The exemptions might or might not reduce income made use of for other purposes, such as IRA limitations, kid credit ratings, individual exceptions, and so on.These exclusions do not excuse the earnings from United States taxes but simply provide a tax obligation reduction. Note that a bachelor functioning abroad for every one of 2025 that gained concerning $145,000 with no various other revenue will have gross income decreased to zero - efficiently the same response as being "tax obligation complimentary." The he has a good point exclusions are computed every day.

Report this wiki page